Fidel Oswaldo Castro: Navigating Legacy And Financial Horizons

In a world where names often carry profound historical weight and personal significance, the name Fidel resonates with a unique blend of steadfastness and historical narrative. When we consider "Fidel Oswaldo Castro," we embark on an exploration that touches upon the very essence of fidelity—both as a personal virtue and as a guiding principle in financial stewardship. This article delves into the layers of meaning embedded within this compelling name, examining its etymological roots, its most famous historical bearer, and its surprising connection to the world of personal finance, particularly through the lens of a prominent institution like Fidelity.

Our journey will unfold through the intricate tapestry of language, history, and modern financial planning. We will explore how the concept of faithfulness, inherent in the name Fidel, can be a cornerstone for building a secure financial future, and how entities like Fidelity provide the tools and platforms to achieve such steadfast goals. Join us as we unravel the multifaceted dimensions of "Fidel Oswaldo Castro," moving from historical echoes to practical financial strategies.

Table of Contents

- The Name Fidel: A Legacy of Faithfulness and Notoriety

- Fidel Oswaldo Castro: A Conceptual Profile

- Navigating Financial Futures: The Fidelity Connection

- Intelligent Tools for Smarter Investment Decisions

- Diverse Investment Avenues: Fidelity Funds and Asset Classes

- Building a Secure Future: Saving for Life's Milestones

- The Principles of E-E-A-T in Financial Planning

- Conclusion: The Enduring Significance of Financial Prudence

The Name Fidel: A Legacy of Faithfulness and Notoriety

The name "Fidel" carries a deep historical and linguistic resonance, often evoking images of steadfastness and commitment. Its origins are firmly rooted in Latin, providing a strong foundation for its enduring meaning and widespread use across various cultures.

- Gina Caputo Dermatologist

- Emory Farmworker Project

- Levi Turner Birthday

- El Ojo De San Pedro

- Canap%C3%A3 Lit Convertible Center

Etymology and Enduring Meaning

At its core, "Fidel" is a given name derived from the Latin word fidelis, which translates directly to "faithful." This etymological root imbues the name with qualities of loyalty, trustworthiness, and unwavering commitment. It suggests a person who is reliable, true to their word, and dedicated to their principles or loved ones. The feminine derivative of Fidel is Fidelia, sharing the same noble connotations of faithfulness and devotion. This inherent meaning has made Fidel a popular name in many Spanish and Portuguese-speaking countries, reflecting a cultural appreciation for these virtues. Notable people throughout history and in various fields have borne this name, further cementing its place in the collective consciousness as a symbol of fidelity.

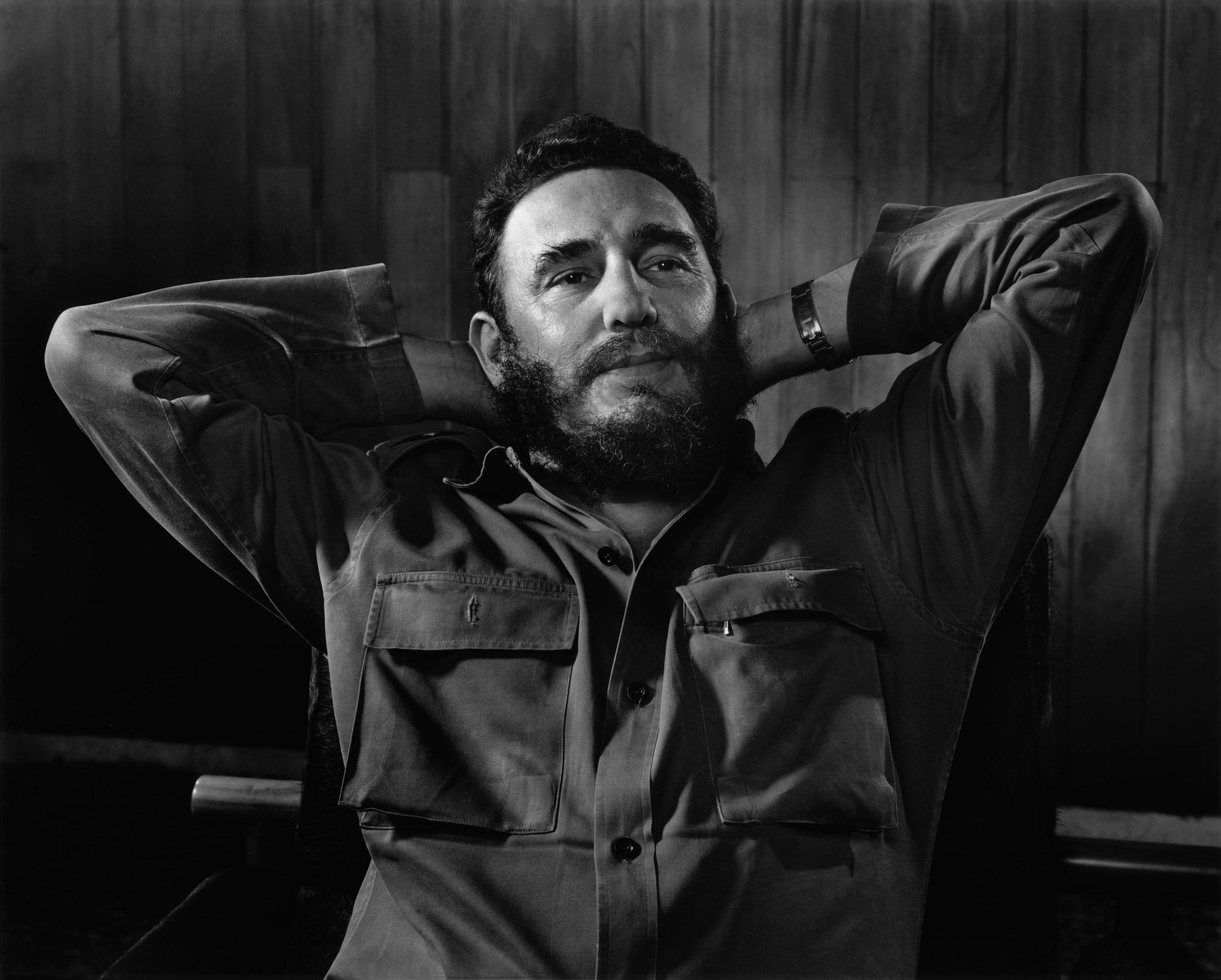

The Shadow of a Statesman: Fidel Castro's Impact

While the name Fidel signifies faithfulness, its most common and globally recognized association is undoubtedly with Fidel Castro, the revolutionary and long-time leader of Cuba. His political career and the Cuban Revolution profoundly shaped 20th-century history, making "Fidel" a name synonymous with a powerful, often controversial, political figure. The 2002 American biographical drama television film, Fidel, titled onscreen as ¡Fidel!, directed by David Attwood, vividly portrays the Cuban Revolution and the political ascent of Fidel Castro, played by Víctor. This film, among countless books, documentaries, and historical analyses, underscores the immense impact of Fidel Castro on global politics and the indelible mark he left on the historical narrative. When one encounters the name "Fidel," particularly in a broader context, it is almost impossible not to acknowledge the historical weight and complexity brought by this prominent figure. Understanding the definition of Fidel, as found in resources like the definitions.net dictionary, often includes references to its most famous bearer, highlighting the interplay between a name's inherent meaning and its historical embodiment.

Fidel Oswaldo Castro: A Conceptual Profile

While "Fidel Oswaldo Castro" does not refer to a widely recognized public figure with a documented biography, for the purpose of this exploration, we envision a conceptual individual who embodies the themes inherent in the name "Fidel" and the financial principles suggested by "Fidelity." This section serves as a thematic 'biography' to explore the potential journey of such a person in navigating life's financial landscape, drawing connections between the name's meaning and the pursuit of financial well-being. This approach allows us to delve into the practical applications of concepts like faithfulness and strategic planning in personal finance, all under the symbolic umbrella of "Fidel Oswaldo Castro."

- Delta Gamma Florida State

- Unique Return Gift Ideas

- Chicago All White Party

- Reebok Soulja With Strap

- Chicago Childrens Theater

Here is a conceptual profile, outlining the thematic attributes associated with our hypothetical "Fidel Oswaldo Castro":

| Attribute | Conceptual Interpretation |

|---|---|

| Name Meaning | "Faithful" (Fidelis) – Reflecting diligence, commitment, and reliability in financial planning and personal commitments. |

| Historical Echo | Bearing a name associated with significant historical figures (Fidel Castro), suggesting an awareness of legacy and impact. |

| Financial Focus | Seeking reliable and trustworthy avenues for saving and investment, such as those offered by established financial institutions like Fidelity. |

| Life Goals | Aims for significant personal and family milestones, including saving for college education, purchasing a new home, and securing retirement. |

| Approach to Finance | Utilizes intelligent tools, technology, and diverse investment funds for strategic, long-term financial growth and stability. |

| Digital Literacy | Comfortable navigating online financial platforms like Fidelity NetBenefits®, understanding the importance of digital security and cookie policies. |

This conceptualization of "Fidel Oswaldo Castro" allows us to bridge the gap between a historically significant name and the contemporary challenges and opportunities in personal finance, providing a framework for discussing the practical aspects of financial planning in a relatable context.

Navigating Financial Futures: The Fidelity Connection

The transition from the historical resonance of "Fidel" to the practicalities of modern financial planning brings us to Fidelity, a name that itself embodies the concept of faithfulness in the realm of financial services. For someone like our conceptual "Fidel Oswaldo Castro," seeking to build a secure future, understanding the offerings of such an institution is paramount. Fidelity provides a robust platform designed to help individuals manage their wealth, plan for significant life events, and achieve their long-term financial aspirations.

Getting Started with Fidelity NetBenefits®

For many, the first step into managing their financial future with Fidelity begins with platforms like Fidelity NetBenefits®. This online portal serves as a gateway for individuals to access their retirement plans, investment accounts, and other financial tools. For those new to Fidelity NetBenefits®, the platform is designed to be user-friendly, guiding individuals through the process of setting up and managing their accounts. As with any online service, using this website implies consent to the use of cookies, as described in their policies. This standard practice ensures a personalized and secure online experience. However, if you do not agree to our cookies policy, you can adjust your browser settings accordingly, though this might affect certain functionalities. This transparency is crucial for building trust, a core component of E-E-A-T principles in the financial sector.

The Foundation of Financial Growth: No Fees, No Minimums

A significant barrier for many individuals considering investment or savings accounts is the concern over fees and minimum balance requirements. Fidelity addresses these concerns directly by offering accounts with no account fees and no minimum balances required. This policy democratizes access to financial tools, making it easier for individuals, including our conceptual "Fidel Oswaldo Castro," to start saving and investing regardless of their initial capital. This accessibility is a powerful incentive, encouraging more people to take control of their financial destinies without the burden of prohibitive costs. It allows for incremental growth, where even small, consistent contributions can accumulate over time, fostering a habit of financial discipline that aligns perfectly with the "faithful" meaning of the name Fidel.

Intelligent Tools for Smarter Investment Decisions

In today's complex financial landscape, making informed investment decisions can be challenging. This is where advanced technology and intelligent tools become indispensable. For someone like "Fidel Oswaldo Castro" who aims for strategic financial growth, leveraging such resources is key. Fidelity prides itself on providing cutting-edge tools and technology designed to empower investors.

Our intelligent tools and technology can help you make smarter trading decisions. These tools often include:

- Advanced Research Platforms: Access to comprehensive market data, analyst reports, and company fundamentals to inform investment choices.

- Portfolio Analysis Tools: Features that allow users to analyze their current portfolio's performance, diversification, and risk exposure, helping them identify areas for improvement.

- Goal-Based Planning: Tools that help set financial goals (like saving for a new home or college) and then model various investment strategies to achieve those goals within a specific timeframe.

- Educational Resources: A wealth of articles, webinars, and tutorials that demystify complex financial concepts, enabling investors to learn at their own pace.

- Real-time Market Data and Alerts: Providing up-to-the-minute information and customizable alerts to help investors react quickly to market changes.

- Robo-Advisors: Automated investment management services that construct and manage portfolios based on an individual's risk tolerance and financial goals, offering a hands-off approach for those who prefer it.

These technological advancements remove much of the guesswork from investing, providing data-driven insights and personalized guidance. They allow investors, whether seasoned or new, to approach the market with greater confidence and precision, aligning their actions with their long-term strategic investment goals. The ability to access such sophisticated support underscores the commitment to client success, transforming complex financial decisions into manageable, informed choices.

Diverse Investment Avenues: Fidelity Funds and Asset Classes

A cornerstone of effective financial planning is diversification, and for a forward-thinking individual like "Fidel Oswaldo Castro," having access to a wide array of investment options is crucial. Fidelity stands out in this regard, offering an extensive selection of funds that cater to various risk appetites and investment objectives. This breadth of choice ensures that investors can construct a portfolio that truly reflects their unique financial situation and aspirations.

Fidelity funds cover all asset classes of mutual funds, from domestic equity to specialized sectors. This comprehensive coverage means that investors can find the mix of funds that helps them to achieve their strategic investment goals. This includes:

- Domestic Equity Funds: Investing in stocks of companies based within the home country, offering exposure to the national economy. These can range from large-cap, established companies to small-cap, high-growth firms.

- International and Global Equity Funds: Providing diversification beyond domestic borders, investing in companies across various countries and regions, which can help mitigate country-specific risks and capture growth opportunities worldwide.

- Fixed Income Funds: Investing in bonds and other debt instruments, offering a potentially more stable return profile and acting as a counterbalance to equity volatility. These include government bonds, corporate bonds, and municipal bonds.

- Money Market Funds: Low-risk funds that invest in highly liquid, short-term debt instruments, often used for cash management and as a safe haven.

- Balanced Funds: A mix of equities and fixed income, designed to provide a blend of growth and income, often with a specific target allocation that adjusts over time.

- Sector-Specific Funds: Focusing on particular industries or sectors, such as technology, healthcare, energy, or real estate, allowing investors to target specific growth areas or themes.

- Target-Date Funds: Designed for retirement savings, these funds automatically adjust their asset allocation over time, becoming more conservative as the target retirement date approaches.

- Index Funds and ETFs: Passive investment vehicles that aim to track the performance of a specific market index, offering broad market exposure at typically lower costs.

The ability to select from such a diverse range of funds allows investors to tailor their portfolios precisely to their strategic investment goals, whether those goals are aggressive growth, stable income, or a balanced approach. This extensive selection empowers individuals like "Fidel Oswaldo Castro" to build a robust and resilient financial future, aligning their investments with their long-term vision and risk tolerance.

Building a Secure Future: Saving for Life's Milestones

The journey of life is marked by significant milestones, each requiring careful planning and financial preparation. For our conceptual "Fidel Oswaldo Castro," the commitment to these future events is a testament to the "faithful" meaning of his name. Financial institutions like Fidelity play a crucial role in helping individuals systematically save and invest for these pivotal moments, transforming aspirations into achievable realities.

We can help you save for college, a new home, or retirement. These are some of the most common and impactful financial goals individuals strive for:

- Saving for College: Education is a powerful investment in the future. Fidelity offers various college savings plans, such as 529 plans, which provide tax advantages and flexible investment options to help families accumulate funds for tuition, room and board, and other educational expenses. Planning early for college can significantly alleviate the financial burden later, ensuring that educational opportunities are within reach for future generations.

- Saving for a New Home: Homeownership is a quintessential American dream and a major financial undertaking. Whether it's a first home, a larger family residence, or a vacation property, saving for a down payment requires discipline and strategic planning. Fidelity provides tools and accounts that can help individuals set realistic savings goals, track their progress, and invest their funds wisely to grow their down payment over time, making the dream of a new home a tangible reality.

- Saving for Retirement: Perhaps the most critical long-term financial goal, retirement planning ensures financial independence and security in later life. Fidelity offers a wide range of retirement accounts, including IRAs (Traditional, Roth, SEP, SIMPLE) and 401(k) plans, along with comprehensive planning tools. These resources help individuals determine how much they need to save, choose appropriate investments, and create a sustainable income stream for their post-working years. The earlier one starts saving for retirement, the more time their investments have to grow through compounding, embodying the long-term faithfulness implied by the name Fidel.

Beyond these major milestones, Fidelity's services also extend to other general savings goals, such as building an emergency fund, saving for a major purchase, or planning for a family vacation. The overarching aim is to provide individuals with the platforms, tools, and guidance necessary to systematically work towards their financial objectives, ensuring that their future is as secure and prosperous as possible. This comprehensive support underscores the institution's role as a trusted partner in life's financial journey.

The Principles of E-E-A-T in Financial Planning

When discussing financial matters, especially those that touch upon an individual's money and life, adhering to the principles of E-E-A-T (Expertise, Experience, Authoritativeness, Trustworthiness) and YMYL (Your Money or Your Life) content is paramount. For a conceptual figure like "Fidel Oswaldo Castro" navigating financial decisions, the reliability of information and the credibility of financial institutions are non-negotiable. This section explores how these principles apply to the financial services discussed and why they are vital for public trust.

- Expertise: Financial institutions like Fidelity demonstrate expertise through their deep understanding of market dynamics, investment strategies, and regulatory frameworks. Their teams of financial advisors, analysts, and technologists possess specialized knowledge that enables them to develop sophisticated tools and offer informed guidance. For an individual, seeking advice from or utilizing platforms built by such experts ensures that decisions are based on sound financial principles.

- Experience: Experience in the financial sector is built over years, even decades, of market cycles, economic shifts, and client interactions. A long-standing institution has a proven track record of helping clients through various economic conditions. This experience translates into robust systems, refined strategies, and a nuanced understanding of investor needs, providing a sense of security and reliability.

- Authoritativeness: Authoritativeness in finance comes from being a recognized leader in the industry, often evidenced by regulatory compliance, industry awards, and the sheer volume of assets under management. When a financial entity is cited as a reliable source of information or a benchmark for best practices, it establishes its authority. For the individual investor, choosing an authoritative platform means relying on a source that is well-regarded and influential within the financial community.

- Trustworthiness: Trustworthiness is the bedrock of any financial relationship. It is built through transparency, ethical practices, and a consistent commitment to acting in the client's best interest. Policies like "no account fees and no minimum balances required," clear cookie policies, and readily available customer support contribute significantly to building trust. In the context of YMYL content, where financial decisions can have life-altering impacts, trustworthiness ensures that individuals can confidently entrust their savings and investments to a reputable provider.

The consistent application of E-E-A-T principles by financial service providers like Fidelity ensures that individuals like our conceptual "Fidel Oswaldo Castro" receive accurate, reliable, and beneficial information and services. This commitment to quality and integrity is what allows people to make informed decisions that positively impact their financial health and overall well-being.

Conclusion: The Enduring Significance of Financial Prudence

Our journey through the multifaceted layers of "Fidel Oswaldo Castro" has revealed a compelling narrative that intertwines the profound meaning of a name with the practical realities of modern financial planning. From the Latin roots of "Fidel," signifying faithfulness and loyalty, to the historical weight carried by prominent figures, we've seen how a name can echo through time and influence perception. More importantly, we've explored how the very essence of fidelity—steadfastness, commitment, and trustworthiness—is indispensable in the realm of personal finance.

Through the lens of our conceptual "Fidel Oswaldo Castro," we've highlighted the crucial role of institutions like Fidelity in empowering individuals to achieve their financial aspirations. The ability to save for significant milestones like college or a new home, the accessibility offered by no account fees and no minimum balances, the power of intelligent tools for smarter trading, and the comprehensive range of mutual funds across all asset classes—all these elements underscore the importance of choosing a reliable partner in one's financial journey. The principles of E-E-A-T are not just guidelines for content creation; they are fundamental requirements for any entity entrusted with an individual's financial well-being, ensuring expertise, authoritativeness, and unwavering trustworthiness.

Ultimately, the story of "Fidel Oswaldo Castro" serves as a powerful reminder that financial prudence is a continuous act of faithfulness—faithfulness to one's future self, to one's family, and to one's long-term goals. It's about making informed decisions, leveraging available resources, and consistently working towards a secure and prosperous tomorrow. Just as the name Fidel symbolizes unwavering commitment, so too should our approach to managing our finances be characterized by diligence and strategic foresight.

What are your thoughts on the interplay between personal values and financial decisions? Share your insights in the comments below, or explore other articles on our site to deepen your understanding of effective financial planning strategies!

- Stephanie Young Pottery

- Fashion Photographer Los Angeles

- Phil X Signature Guitar

- Dr Michael Lovell

- Arroz Food Truck

Fidel Castro – Yousuf Karsh

Fidel Castro: Quotes | Britannica

Fidel Castro: Quotes | Britannica